CuraDebt Debt Relief Services: Empower You to Navigate Financial Recovery

Introduction: Debt Relief Services

If you’re facing overwhelming debt, CuraDebt emerges as a guiding light, offering specialized debt relief services to individuals grappling with financial challenges. Established with a mission to assist consumers in their journey towards financial freedom, CuraDebt employs a comprehensive debt settlement approach, negotiating with creditors on your behalf to alleviate the burden of debt.

Unraveling CuraDebt’s Debt Relief Services: An In-Depth Review

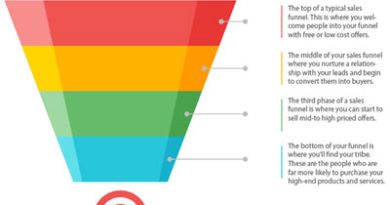

The Process Unveiled

CuraDebt’s modus operandi revolves around debt settlement, a strategic negotiation with your creditors aimed at reducing your debt obligations. This meticulous process enables you to pay back substantially less than your outstanding balance, offering a pathway to financial solace.

Assessing Candidacy

Curious if CuraDebt’s services align with your needs? The initial step involves a complimentary consultation, delving into your financial landscape to determine the suitability of debt settlement for your circumstances.

Pros and Cons: A Balanced Outlook

CuraDebt presents an array of advantages:

- Zero Upfront Fees: Enrolling incurs no upfront charges, ensuring payment only upon successful negotiation, typically around 20% of each settled debt.

- Insightful Consultation: Access a free consultation to gauge the viability of debt settlement for your financial situation.

- Diverse Debt Coverage: From unsecured debts to tax-related obligations, CuraDebt extends its support across various debt categories.

However, certain limitations exist:

- Absence of Mobile App: Currently lacking a mobile application for streamlined progress tracking.

- No Money-Back Guarantee: Unlike some counterparts, CuraDebt doesn’t offer a satisfaction or money-back guarantee.

- Service Limitations: Not accessible in all 50 states: CuraDebt does not serve residents of 13 states: HAWAII, IDAHO, ILLINOIS, KANSAS, LOUISIANA, MAINE, NEW HAMPSHIRE, OREGON, SOUTH CAROLINA, TENNESSEE, UTAH, VERMONT, AND WEST VIRGINIA.

Scope of Offerings

CuraDebt’s prowess extends across multiple debt types, including:

- Credit Card Debt: Assistance in negotiating and settling credit card debts, irrespective of the issuer.

- Medical Debt: Consolidation of medical debts into a manageable settlement plan.

- Personal Loans and Payday Loans: Addressing various unsecured loans and lines of credit.

- Tax Debts: Dedicated counselors aiding in the resolution of federal and state tax liabilities.

- Private Student Loans: Negotiation opportunities for private student loan debts.

Client-Centric Approach

The onboarding process entails a personalized consultation, empowering you to make informed decisions. Whether through phone consultations or in-person meetings at their Florida headquarters, CuraDebt ensures accessibility and tailored guidance.

Company Reputation and Credibility

Amidst a market rife with predatory practices, CuraDebt distinguishes itself with a commendable reputation. Endorsements from associations like AADR and positive customer reviews underscore its credibility.

Financial Impact and Transparency

CuraDebt anticipates substantial debt reduction, averaging between 40% to 60% of the outstanding balance. Transparent fee structures and a commitment to charging only after delivering results further highlight their integrity.

Final Assessment

In conclusion, CuraDebt stands as a reputable ally in your pursuit of financial stability. While lacking in mobile tools and restricted in its service coverage, its transparent approach, coupled with successful debt negotiation track records, renders it a compelling choice.

Should you seek effective debt relief strategies, consider CuraDebt as a viable partner on your journey to financial recovery.

Signing up with CuraDebt debt relief services may just be the pivotal step towards a debt-free future.